Just as gold is trading near its all-time high, silver is also hitting historically high levels. Many investors hesitate to buy silver now because they fear its price may have already peaked. However, silver has qualities that distinguish it from gold. While both are precious metals, silver has important industrial uses, which make it both a store of value and a vital industrial asset. Knowing these factors is essential for anyone thinking about adding silver to their investment portfolio.

Why Gold Prices Are Rising

Gold has always been viewed as a safe investment, especially when the economy is uncertain. Recently, the rising U.S. national debt, now over $38 trillion, has shaken confidence in the U.S. dollar. Because of this, many investors, including central banks like China, are turning to gold to safeguard their wealth. Analysts believe that gold could keep rising and may reach $10,000 per ounce in the next few years. Gold serves as both a financial safety net and a cultural treasure. In many countries, people have traditionally used gold for jewelry and to store family wealth. Its value helps maintain purchasing power over time, shielding investors from currency losses.

The Gold-Silver Connection

Silver usually follows gold’s trend, but with a slight delay. Investors often look at the gold-to-silver ratio to evaluate silver’s potential for growth. Currently, the ratio is about 1:84, meaning it takes 84 ounces of silver to equal one ounce of gold. In the past, this ratio has dropped to around 1:35 during times when silver surged against gold, like in 2011. If this ratio goes down to levels like 60 or even 50, silver could experience significant price increases. Experts also note that if gold reaches $10,000 per ounce, silver could hypothetically hit $500 per ounce, assuming the ratio changes to about 20:1. This shows the potential for high returns in silver over the long term, especially when looking at the bigger picture instead of short-term market changes.

Silver Prices in the Context of Inflation

Silver’s historical highs, when adjusted for inflation, suggest it is still undervalued. In 1980 and again in 2011, silver reached about $52 per ounce. Adjusting for today’s inflation, that would be roughly $135 per ounce. This means that at current prices near $50 per ounce, silver is trading below its true, inflation-adjusted value. Historically, when silver fell behind its adjusted value, it quickly made up the difference. This pattern could make it a potentially profitable investment.

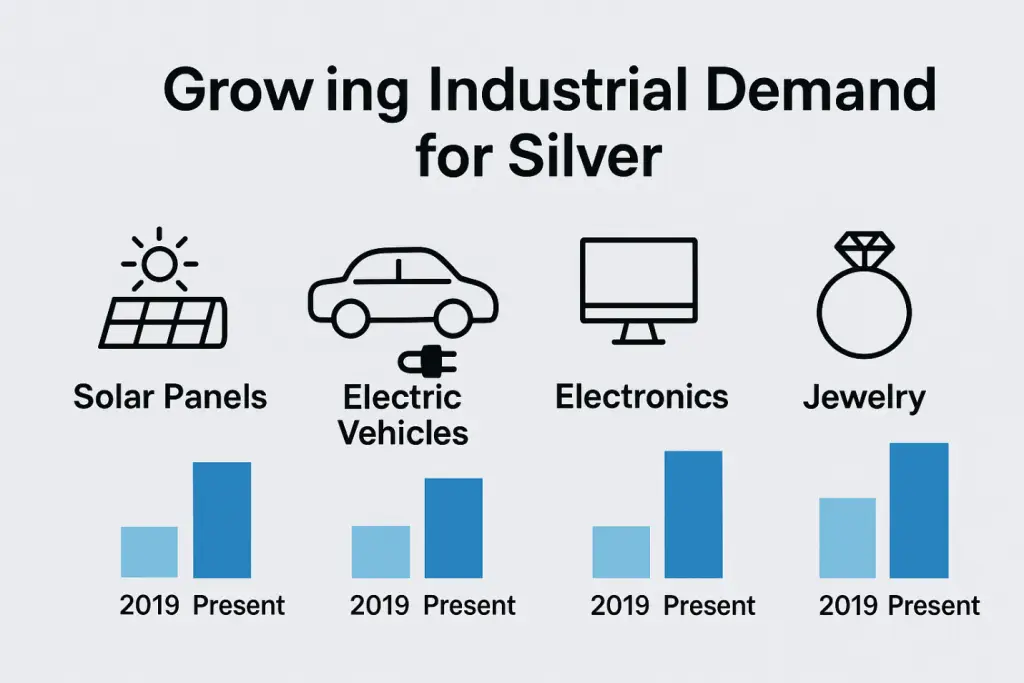

Growing Industrial Demand for Silver

Unlike gold, silver plays a significant role in various industries. It is crucial for electronics, solar panels, electric vehicles, photography, and many industrial uses. The demand for silver in industry has increased sharply in recent years, rising from about 530 million ounces in 2019 to over 680 million ounces today. This rising demand is mainly due to the global move toward renewable energy and electric transportation. For instance, solar panels depend heavily on silver for electrical conductivity, and electric vehicles need large amounts of silver for batteries and electronics. This growing industrial need, along with limited mining output, creates a supply-demand imbalance that may push silver prices higher over time.

Investment Strategy

For a balanced portfolio, experts suggest the following allocation:

- Gold: Around 10% of total assets

- Silver: Around 5% of total assets

Gold serves as a store of value and helps preserve wealth during inflation. Silver, on the other hand, has higher growth potential because of its industrial demand. However, investors should avoid using leverage. Leveraged positions in volatile commodities like silver can lead to significant losses. In Pakistan and around the world, investors can buy silver either physically from jewelers or digitally through trusted investment platforms.

The Bottom Line

Silver offers a strong long-term investment opportunity. Increasing industrial demand, restricted mining supply, and falling trust in fiat currencies like the U.S. dollar suggest potential growth. By adding silver to a diverse portfolio with gold, investors can safeguard their wealth and improve growth potential. Whether in the form of jewelry, bars, coins, or digital investment platforms, silver serves as both a precious and industrial metal. This unique position makes it well-suited for future gains. For investors looking to get involved in the metals market, a careful investment in silver now could lead to significant rewards in the coming years.