The federal government revised profit rates for National Savings Schemes, effective November 4, 2025. Let’s break down the changes and see how they impact your investments.

What’s Changed?

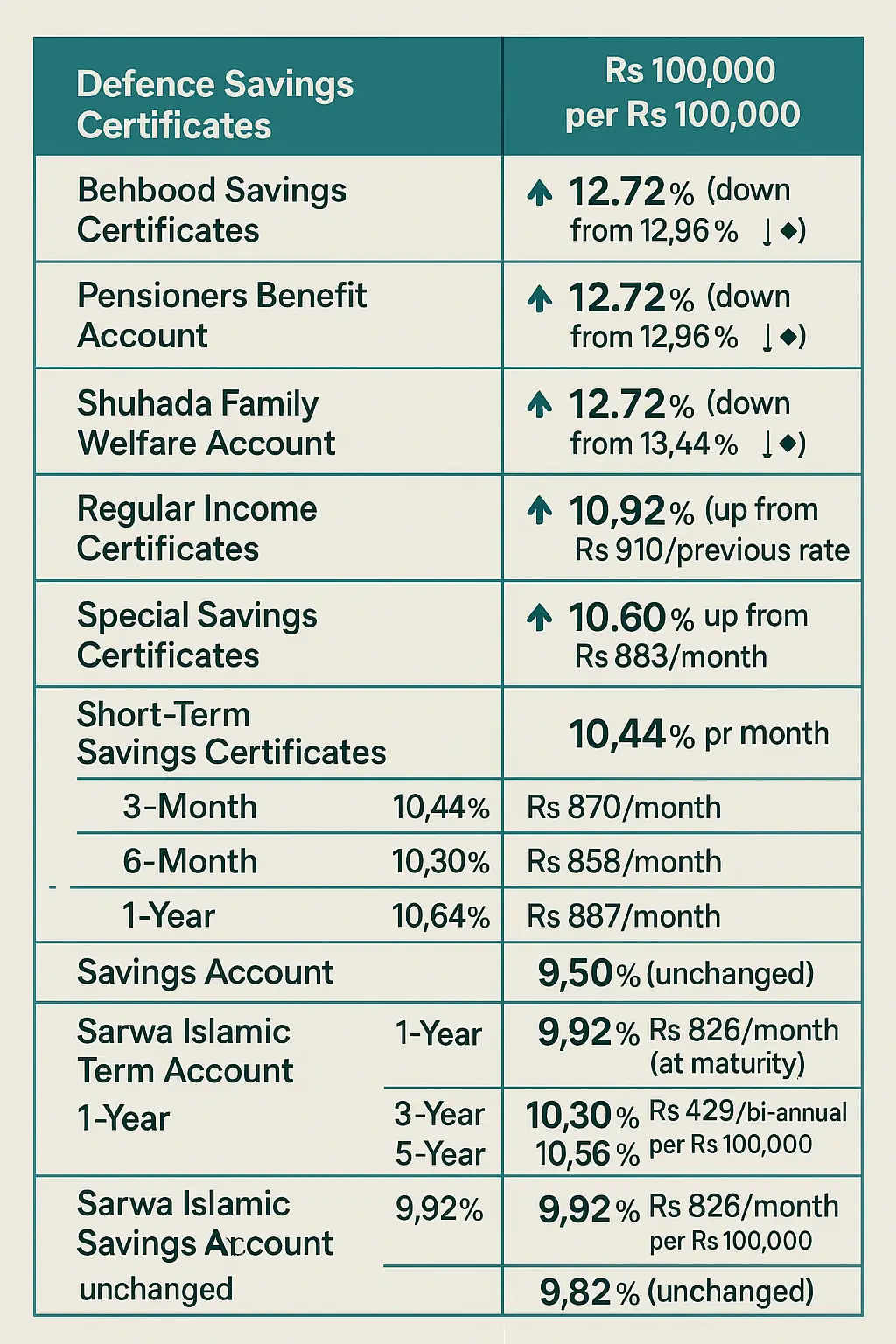

– Defence Savings Certificates: 11.31% (down from 11.42%) – Rs 943/month per Rs 100,000

– Behbood Savings Certificates: 12.72% (down from 12.96%) – Rs 1,060/month per Rs 100,000

– Pensioners Benefit Account: 12.72% (down from 12.96%) – Rs 1,060/month per Rs 100,000

– Shuhada Family Welfare Account: 12.72% (down from 13.44%) – Rs 1,060/month per Rs 100,000

– Regular Income Certificates: 10.92% (up from 10.80%) – Rs 910/month per Rs 100,000

– Special Savings Certificates: 10.60% (up from previous rate) – Rs 883/month per Rs 100,000

– Short-Term Savings Certificates:

– 3-Months: 10.44% – Rs 870/month per Rs 100,000

– 6-Months: 10.30% – Rs 858/month per Rs 100,000

– 1-Year: 10.64% – Rs 887/month per Rs 100,000

– Savings Account: 9.50% (unchanged) – Rs 792/month per Rs 100,000

– Sarwa Islamic Term Account:

– 1-Year: 9.92% – Rs 826/month per Rs 100,000 (at maturity)

– 3-Year: 10.30% – Rs 429/bi-annual per Rs 100,000

– 5-Year: 10.56% – Rs 880/month per Rs 100,000

– Sarwa Islamic Savings Account: 9.92% (unchanged) – Rs 826/month per Rs 100,000

What Does This Mean for You?

These revised rates apply to fresh deposits made from November 4, 2025, onwards. If you’re considering investing in National Savings Schemes, now’s a great time to review your options.

Why Invest in National Savings Schemes?

– Secure and government-backed

– Competitive returns

– Flexible tenure options

– Low minimum investment requirements

Next Steps

Visit your nearest National Savings Centre or check the National Savings official website for more information on the revised rates and scheme details.

Stay informed, stay savvy!